Investment Process

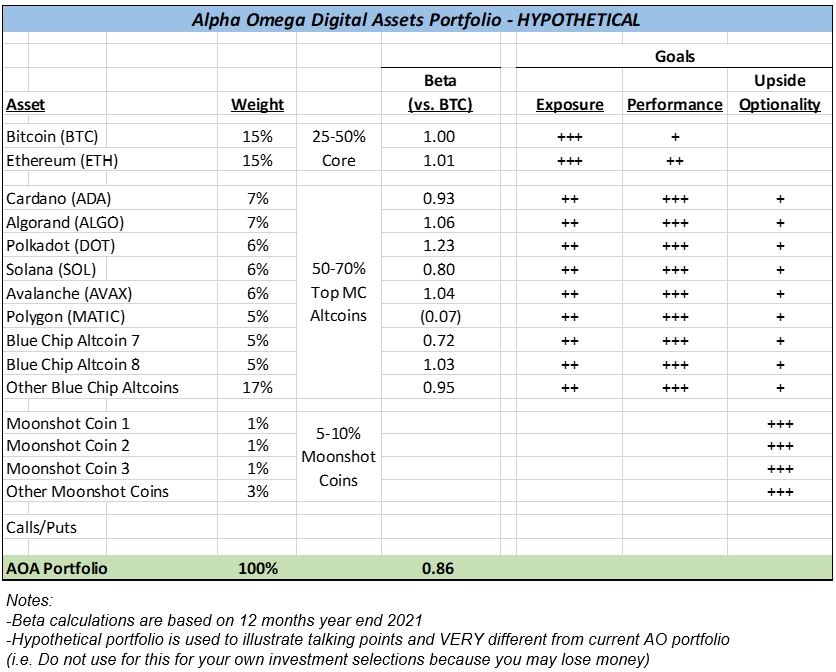

Goals: Exposure, Performance, Optionality

The Portfolio Approach

At Alpha Omega we take a portfolio approach to investing in cryptocurrencies. By combining the benefits of diversification and taking positions in tokens that have superior risk-reward, our aim is to increase returns and lower volatility (beta).

We have three goals for our fund: crypto exposure, superior performance, and upside optionality. Our strategy for achieving those goals involves holding core positions in BTC and ETH, a large allocation towards top market cap altcoins, and a small allocation of moonshot coins. Options are used for hedging downside risk or in unique situations. We anticipate approximately 20-30 long positions in the portfolio at any given time.

Our Process

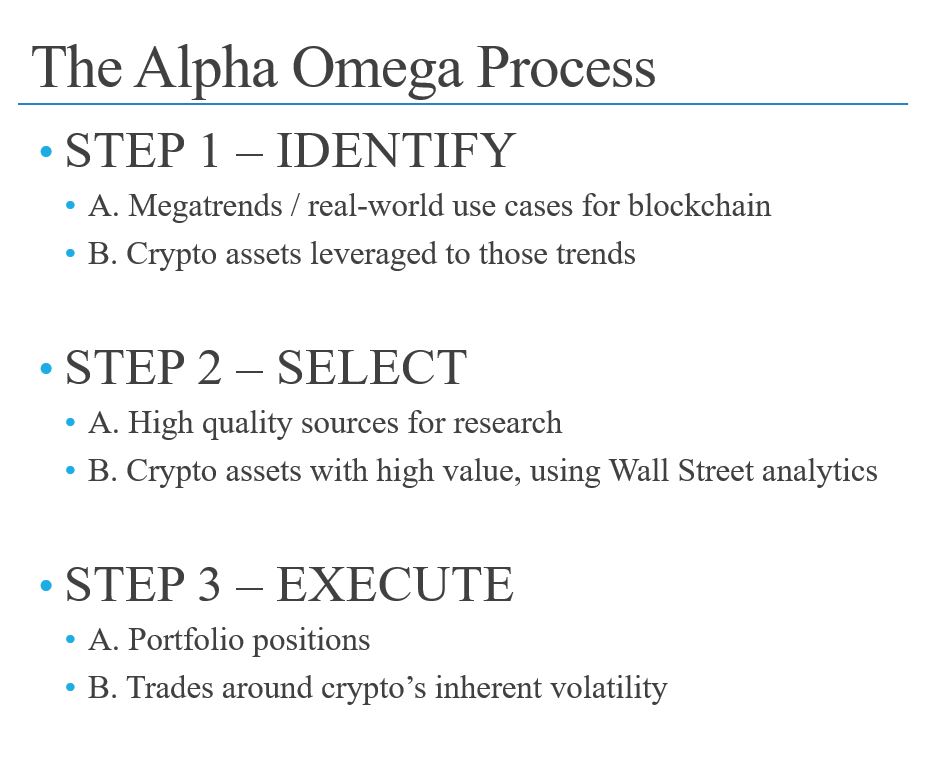

Alpha Omega’s total investment process includes both top-down and bottom-up approaches.

Step 1 – we identify crypto megatrends and the assets levered to their real world use cases. Store of value, AI, and real world assets (RWAs) are a few example megatrends. We then identify the cryptocurrencies exposed to those secular tailwinds and execute our due diligence.

Step 2 – we select high value assets based on a repeatable due diligence framework. We start with selecting high quality sources for news, metrics, and research. On-chain data and tokenomics are just two examples of those sources. Our goal is to bring a certain level of Wall Street analysis, such as relative valuation, to our research process and select assets with superior risk-reward propositions.

Step 3 – we construct our portfolio and execute our positions. Our top-down approach sets up the portfolio thematic/megatrend allocations, and we fill those allocations with cryptocurrencies screened from Step 2. We also embrace the volatile nature of the crypto asset class, finding favorable entry and exit points.

Risk Control

Digital assets remain a very nascent sector, and thus investments in the sector remain on the high end of the risk-reward spectrum. In other words, that higher risk should be accompanied by higher return potential.

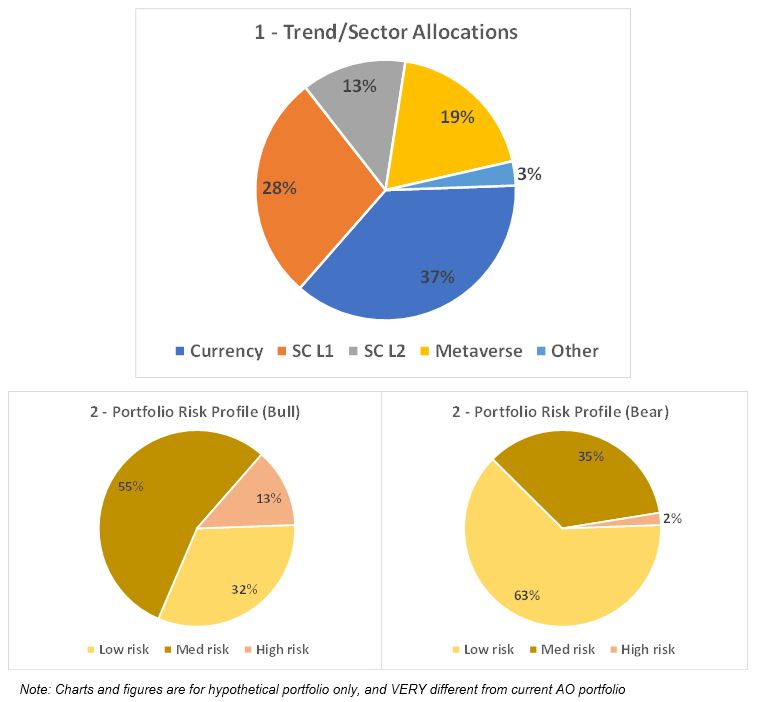

At Alpha Omega we try to improve the risk-reward ratio by undertaking the the investment process described on this page. Our active portfolio chooses weights for crypto themes that have secular hypergrowth, but at the same time avoids over-exposure to any one subsector. We also actively adjust the overall risk of the portfolio based on where we are in the crypto cycle. For example, the positions we hold in the bull portion of the cycle are more aggressive, versus the more defensive positions in a bear market. We do not borrow or buy assets on margin, as we believe there are less risky methods to gain leveraged exposure in the crypto space should an opportunity call for it.

For a more detailed explanation regarding our investment process or philosophy, please contact us for a presentation deck or call.